The missing middle in Merseyside's economy

This article was published as a thought leadership piece in Liverpool Chamber of Commerce’s Well Connected Magazine Summer Edition.

It feels like there’s a lot missing. Secure prospects for the future. Proportionate action on the climate crisis. A sense that collaboration is more than a buzzword, and will really yield material rewards.

‘The economy’ is how we discuss such issues, and this frame has become so ubiquitous that the lenses within it are rarely examined. However, it turns out that the lenses that we - and economists - use are not up to the task. Something essential is missing.

So, what can we say about the economic lenses we currently have? Why do they conceal as much as they reveal? How could an entirely new lens effect change?

Our two familiar lenses can be described as ‘micro’ and ‘macro’. The micro lens is the business (or individual) in isolation: the balance sheet, the inventory, the operations manual. The macro lens is the national statistic: GDP, inflation, unemployment.

Although both have their place, they aren’t sufficient if we’re serious about restoring our hollowed out local economies. One is atomising, and the other is homogenising; neither are empowering. There is a ‘missing middle’ lens on the economy, one which will give us a way to rebuild the markets, institutions, and communities in which we actually live our lives and effect change.

This ‘meso’ lens is network science, and it reveals to us the patterns, flows, and evolution of the economy. It tells us where trade is thriving and where it is stagnating, where there are hidden opportunities for investment, and whether we should be preparing for a storm from an unexpected quarter.

The raw material of science is data, and rapid digitisation - in particular, the widespread adoption of accounting software for issuing and managing invoices - offers an unprecedented opportunity.

At present, this data is siloed: fragmented, disorganised, inaccessible, incompatible, and invisible. But by collecting and analysing it, we can - for the first time ever - start to assemble the meso lens.

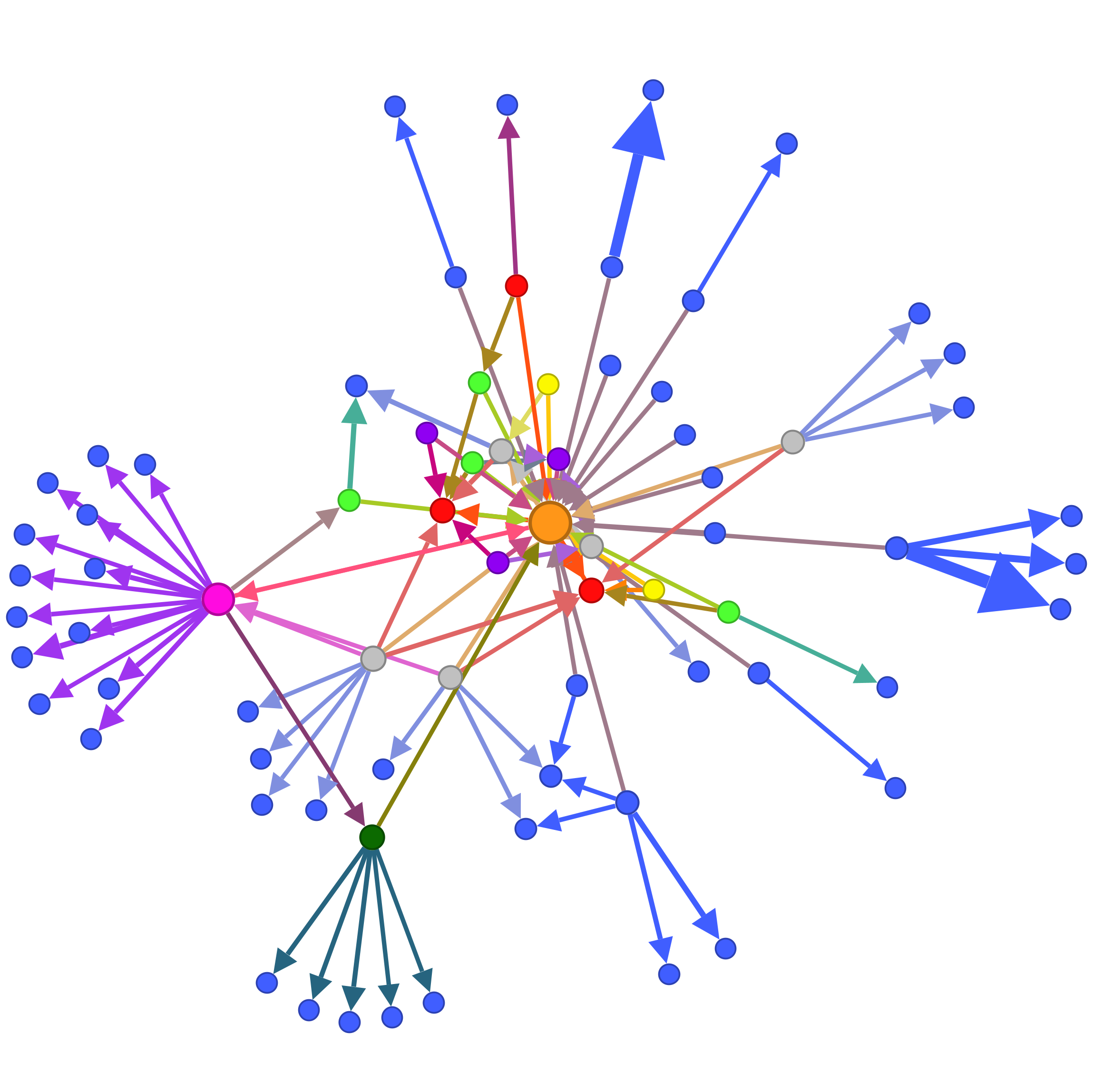

The image below shows a fragment of a local economy: about 30 businesses which have declared their debts to each other, and their wider trading partners. Even this tiny network reveals structures that would be invisible through either the micro or the macro lenses. The analysis of such networks will be most empowering when applied at city-region scales like Merseyside: small enough to be meaningfully ‘local’, big enough for serious impact.

So that this doesn’t come across as largely academic, here are three examples of what these insights mean and the change they will catalyse.

1. For cashflow management

The stressful everyday experience of explaining that ‘I can’t pay because I haven’t been paid’ frequently arises from a proliferation of gridlocks, queues, and bottlenecks in debt networks like the one above. This can be as simple as giving 30 day payment terms, but only receiving 15 days, and so - particularly within dense local trading networks - it’s not surprising that 50% of B2B invoices are paid late.

These situations of fear, uncertainty, and debt cannot be sensibly resolved by one-off micro interventions, such as invoice factoring, or by top-down macro regulations such as payment practice reporting.

The meso lens means applying ‘clearing’ algorithms - adapted from long-standing use in the banking sector - that resolve network gridlocks, allowing debts to be paid on time and with minimal use of cash.

2. For investment

Neither ‘the magic of the market’ or betting the farm on whole-sector initiatives will fill all the niches we need for the local economy to thrive as an ecosystem.

The meso lens means detecting, characterising, and de-risking ‘strategic gaps’ in the network, and boosting circularity within existing business clusters so that each £ can do multiple £s’ worth of work before leaking out.

3. For the local economy as a whole

The knock-on effects of individual insolvencies are currently impossible to account for, and national statistics won’t tell us when the next financial crisis is coming.

The meso lens means understanding and calculating systemic risk in local supply chains, and building tailored models to forecast the outcomes - intended and unintended - of the choices we make, and those we don’t.

These are just a few of the possibilities. In general, the meso lens offers scope for designing interventions that treat people and businesses neither as isolated atoms or a statistical lump.

These will be more appropriate, more collaborative, and more empowering, and thereby more effective in building the city region’s economy. The middle may be missing, but at least now we can see the work at hand.

Comments