Late payments affect our whole community

Late payments don’t just hurt individual businesses

Late payments are sometimes viewed as a minor inconvenience, a simple delay that businesses can manage with a bit of financial juggling. The reality however, is that late payments have far-reaching impacts that extend beyond the immediate frustration of cashflow issues. In tightly interconnected local economies like Merseyside, these delays can cause significant knock-on disruptions, affecting not only the individual businesses involved but also the wider community.

Specifically, one of the most significant challenges in local economies is the emergence of payment gridlocks in dense trading networks. Businesses with highly active local trade (and that therefore contribute the most to the local economy) are often the ones most vulnerable to these gridlocks, and are effectively penalised.

How we intend to help

This is where Local Loop Merseyside will play a transformative role. By applying network-based solutions to invoice data collected from businesses, Local Loop addresses payment gridlocks as a key root-cause of late payments, and mitigates their effects. The platform’s core feature is Loop Clearing, which allows businesses to offset the debts they are owed by other businesses against the debts that they owe.

This ensures that local businesses are no longer at a disadvantage simply because they are active participants in their community’s economy, and in fact creates a direct economic incentive to collaborate. The more businesses that join the network, the stronger the effect becomes, and the greater the benefits for everyone involved. This collaborative model shifts the dynamic from one of risk to one of mutual reward, as businesses see that by working together, they can collectively reduce financial risks and materially improve their overall economic prospects.

Furthermore, by reducing the need for ready cash to make payments, the system alleviates the pressure on businesses to resort to expensive financing options such as overdrafts or invoice factoring. This keeps more money circulating within the local economy, rather than flowing out to large financial institutions in the form of interest payments.

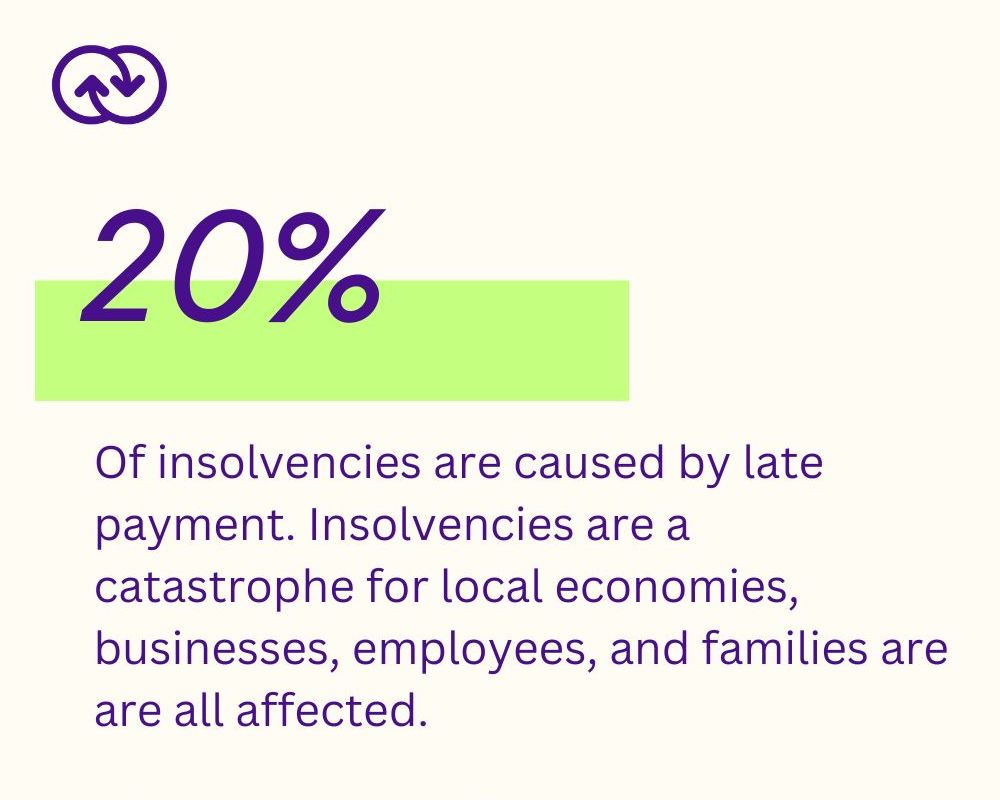

Payment delays within trading networks also create systemic risk and financial instability. Late payments are a leading driver of insolvencies, responsible for around 20% of business closures in the UK. When a company collapses due to cashflow issues, it’s not just the business owner who suffers. The knock-on effects are profound — employees lose their jobs, families feel the strain, and other local businesses in the supply chain are directly impacted. It’s not unusual to see a ripple effect, where the insolvency of one business leads to the closure of others down the supply chain within six months. This domino effect can devastate local economies, leaving lasting scars on communities already struggling with economic challenges.

Further insights

To address this, Local Loop will make further use of invoice data to perform systemic risk analysis within the local trading network. This allows the platform to pinpoint where potential insolvencies may occur and assess their impact on the broader economy. Often, the risk is concentrated not on the largest companies, but on those that occupy critical positions within supply chains. By identifying these risk hotspots, Local Loop can intervene early, working with these businesses to prevent insolvency and protect the integrity of the local economy. This preemptive approach is a game changer, offering a proactive solution to a problem that is usually addressed only after the damage has been done.

The impact of these changes can be profound. As businesses become more resilient and integrated into the local economy, they can reinvest in their neighbourhoods, improving infrastructure, supporting local events, and contributing to community initiatives. This sense of shared prosperity has the potential to reduce economic inequality within neighbourhoods, as more businesses succeed and generate local wealth. From this, an increased sense of community pride, identity, and engagement, as residents and business owners alike see improvements in their neighbourhood, such as revitalised high streets, vibrant local markets, and even better public services.

As communities continue to struggle, late payment goes beyond being a financial obstacle, but a collective challenge. It is crucial for all to recognise the pervading consequences that late payments have on local economies and in turn the social fabric of our neighbourhoods. Addressing this is not just about business—it’s about preserving our communities and protecting the places we call home.

Comments