Credit Clearing and the Missing Middle, Part 1

Credit Clearing and the Missing Middle, Part 1

The global economy feels dominated by large corporate players and financial institutions, while at the grassroots, small and medium-sized enterprises (SMEs) have to navigate an obstacle course of tight credit conditions, cashflow challenges, and uncertain demand. Yet these smaller businesses collectively represent 99.5% of all businesses in Merseyside, and contribute enormously to innovation, community resilience, and our identities. This disparity between large, well-financed corporations and under-resourced smaller firms is what we describe as the ‘Missing Middle’, where SMEs cannot find supportive financial mechanisms that aren’t solely reliant on conventional banking (which don’t work well for them anyway).

The goal of this newsletter series is to explore how clearing represents a real solution for SMEs and local economies. We’ll trace the history of clearing, draw links to its history and key proponents, from economists like John Maynard Keynes and E.F. Schumacher, and demonstrate how these principles are being repurposed today with us here at Local Loop Merseyside. This series of newsletters will show how clearing can fill the financing gap for Merseyside SMEs, and strengthen local resilience in a way traditional finance cannot.

Relevance to SMEs and Local Economies

Clearing eliminates payment gridlocks (“I can’t pay because I haven’t been paid”), reduces your debts and those of your trading partners in the most cash-efficient way possible, and turns your local trading into a superpower. Consider a scenario: a small printing shop in Merseyside might struggle with cashflow because clients pay them late. Meanwhile, the printer owes money to a local packaging supplier, who in turn needs to pay one of those original late-paying clients for design services. Payment gridlocks like this often leave everyone waiting for cash, with all of the stress, uncertainty, and missed opportunities that brings. Clearing allows these businesses to resolve the problem together. This approach is especially powerful for SMEs, which cannot always access traditional lines of credit at manageable interest rates or timelines.

By coming together and forming ‘Clearing Clubs’ (like Local Loop Merseyside!), SMEs can not only ease cashflow pressures for themselves and their trading partners, but also strengthen local supply chains. This empowers regional economies to become more self-reliant and less vulnerable to external shocks, be they economic downturns or disruptions in global finance. This newsletter series unfolds in six further parts, from today through to the end of August, exploring this topic and what it means for you and your business.

Coming up in Future Newsletters

March - The History of Clearing

We’ll look at mediaeval market and clearing fairs, clearing houses created by the early banks.

April - The Rise of Bank Clearing Houses

We’ll discuss the first institutional clearing service, and how systems have developed since then.

May - Theoretical Foundations, Bretton Woods, Bancor, Missed Opportunities

We’ll examine how the political climate after the Second World War sidelined Keynes’ Bancor proposal and explore the long-term implications of that decision for global and local finance. We’ll connect these local experiments to Schumacher’s philosophy of decentralisation and human-scale economies, as well as Keynes’ desire for balanced trade and liquidity management.

June - Government-led clearing in Slovenia

We’ll analyse the modern-day example of clearing for SMEs in Slovenia.

July - Credit Clearing for SMEs: Local Loop Merseyside

We’ll look at us here at Local Loop Merseyside and how we are using multilateral offset to reduce member debts and increase SME resilience in the local economy.

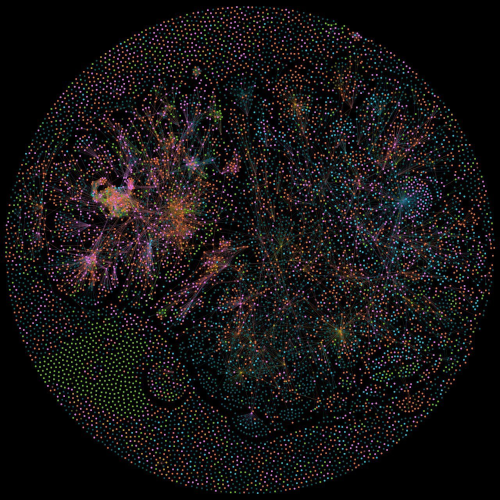

August - Network Science

We’ll discuss how our expert in-house network analysis underpins the impact of Clearing Clubs.

September - The Future

We’ll look at our tech roadmap, some technological enablers, and challenges when scaling

We look forward to sending these newsletters out, and hearing your thoughts! Next month, we’ll be covering the history of clearing. In the meantime, follow us on LinkedIn to see the latest on our mission to build the most collaborative economy in the UK!

Comments